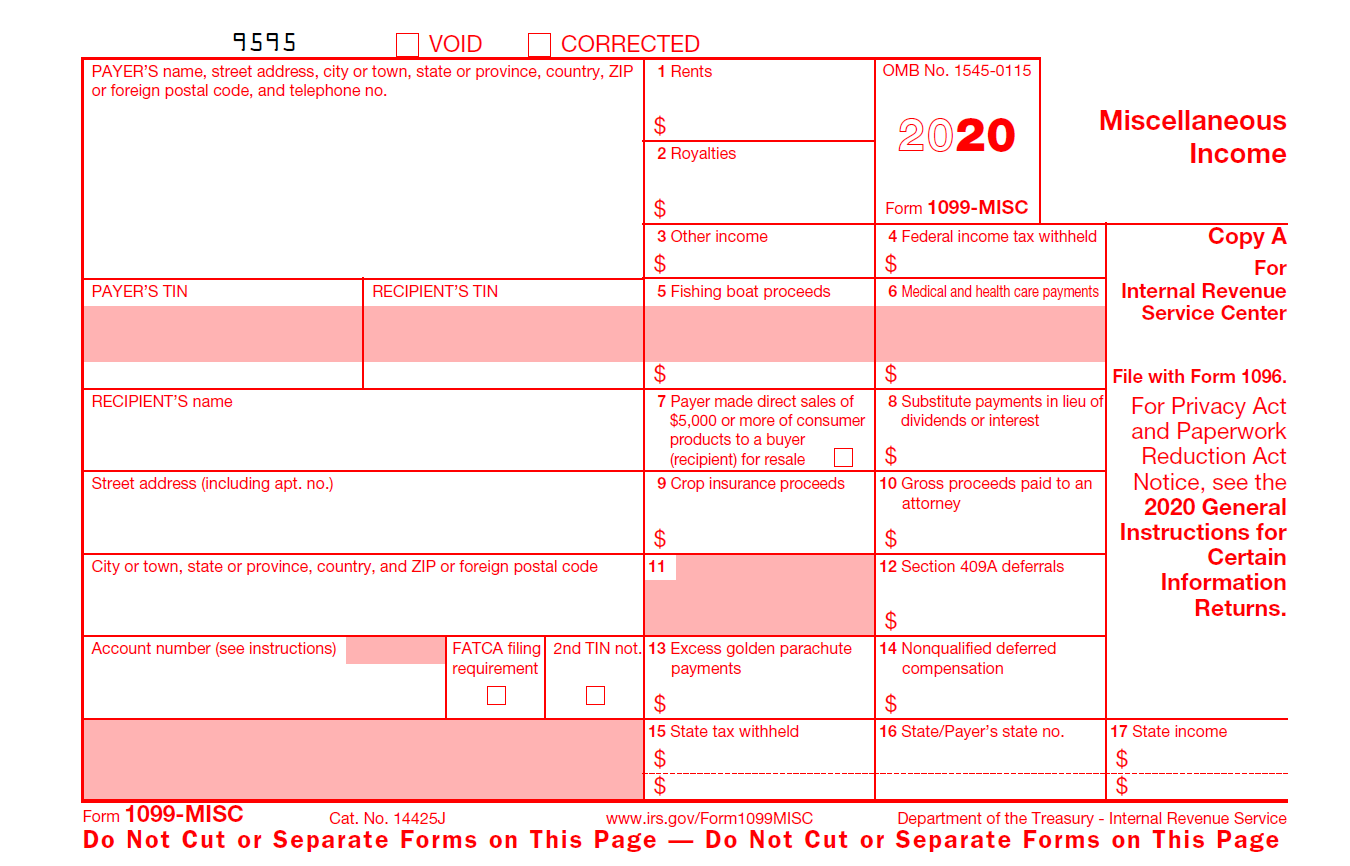

IRS Income Tax Forms Schedules and Publications for Tax Year 2022 – January 1 – December 31 2022. Acquisition or abandonment of secured property.

How To Fill Out A W 9 2019 With Irs W9 2021 In 2021 Tax Forms Irs New Years Eve Events

This allows them to report information like income paid IRA contributions and your capital gains earnings to the IRS.

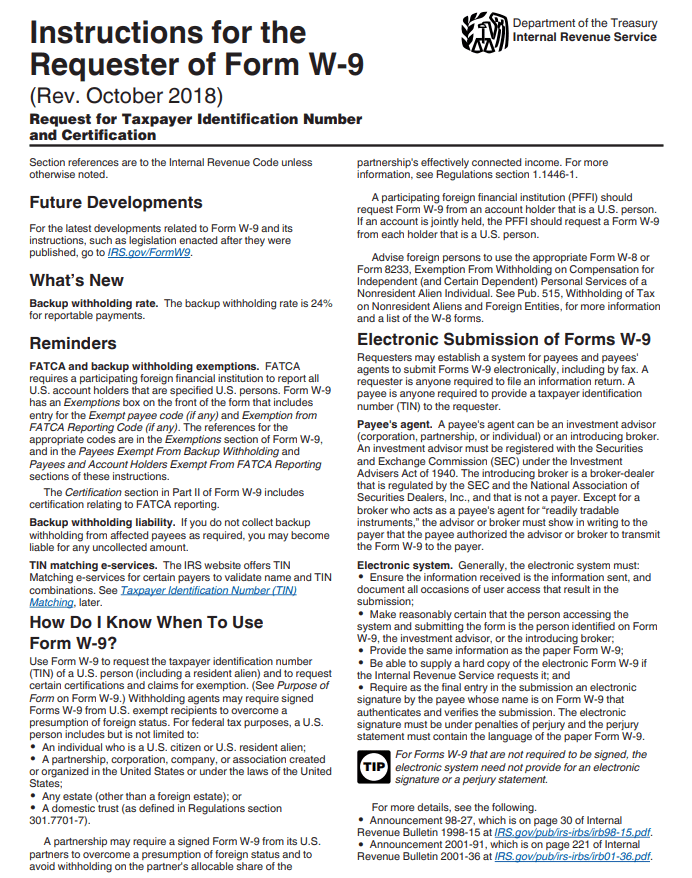

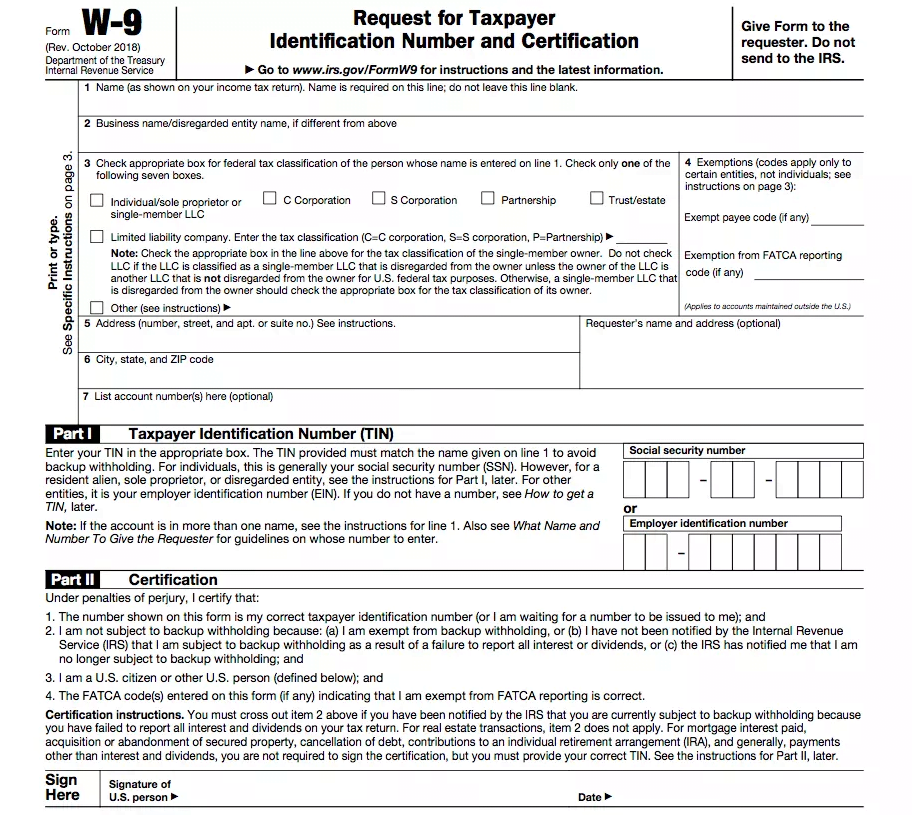

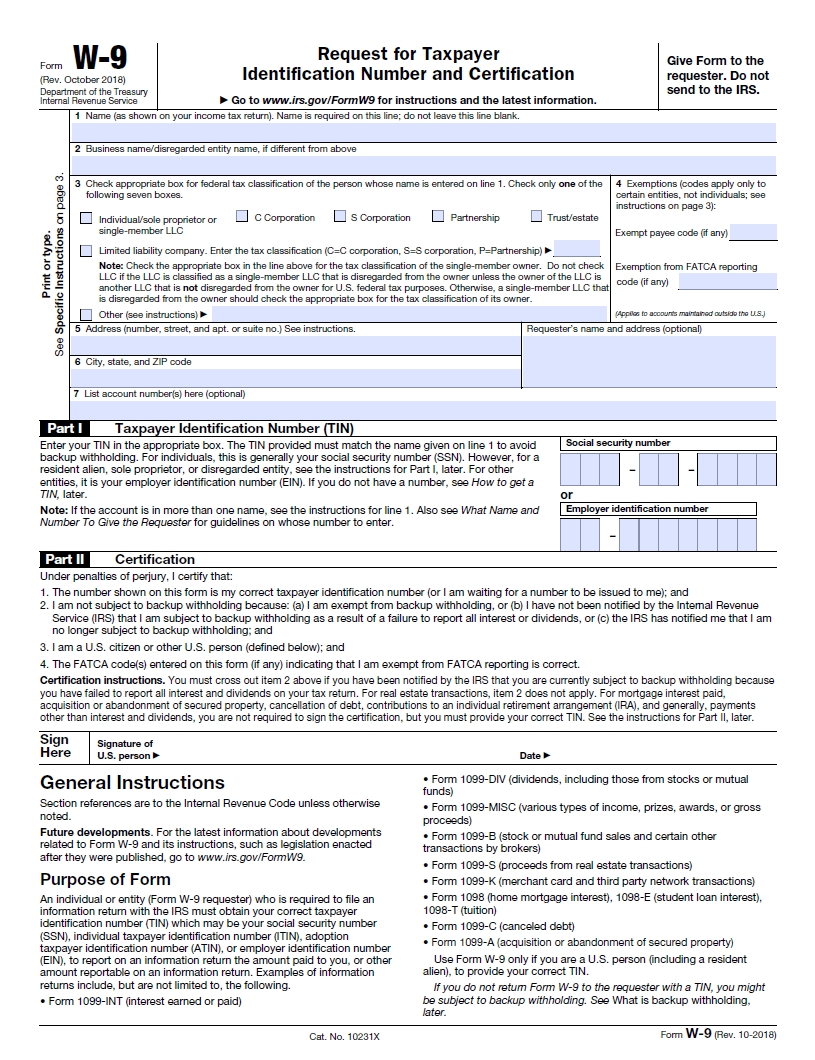

W 9 tax forms 2022. There are plenty of variations of this tax form and the right one for the purposes of the payment must be used. Instead use the appropriate Form W-8 or Form 8233 see Pub. Request for Taxpayer Identification Number and Certification or commonly known in accounting as the W9 is a simple tax form.

Since the requester needs the taxpayer identification number to fulfill tax obligations it is a must to file. W9 Form Request for Taxpayer Identification Number and Certification is a commonly used IRS tax form. Generally only a nonresident alien individual may use the terms of a tax treaty to reduce.

Most payers require the W-9 before they make a payment but regardless of the payment taking place before or after the W-9 is furnished taxpayers must file it. The only IRS tax form where a taxpayer can provide with TIN. 2022 Tax Returns are due on April 15 2023.

Income paid to you. This will allow you to prepare accurately their 1099-NEC forms and report any payments made to. The W-9 or Request for Taxpayer Identification Number and Certification form provides a business with relevant personal info about an independent contractor IC or freelancer for tax purposes in the United States.

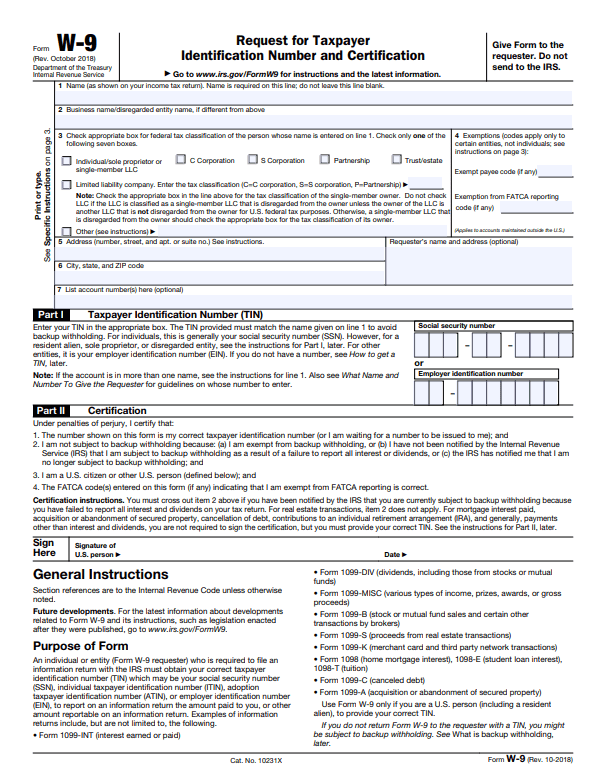

It details the personal information of the requested individual such as name address tax classification and taxpayer identification number. Form W-9 2021 – 2022. What is a W-9 Tax Form Fillable.

The W-9 Request for Taxpayer ID Number and Certification form provides a business with the necessary personal information about an independent contractor or freelancer in order to file tax returns in the United States. The form requires info such as the ICs name address and social safety number SSN. Although its a simple tax form many taxpayers especially the ones who are new to self-employment make a bigger deal out of it.

The form asks about the ICs name and address. Mar – 2021 -. Form W-9 is needed to file information returns to the individuals and businesses to whom youve made payments.

Request for Taxpayer Identification Number and Certification is a simple tax form used for providing a requester with the correct taxpayer identification number. Mortgage interest you paid. Without the information return you wouldnt be able to report the income earned through this.

W9 Form 2022 Request for Taxpayer Identification Number is the renowned tax form used for providing the correct Social Security or Employer Identification Number of taxpayers to payers. Nonresident alien who becomes a resident alien. Form W9 gives the taxpayer identification number to the payers who are required to file information returns to the recipients.

Form W9 is mandatory to file upon request. Start filling out W9 Form 2022 online. The IRS requires payments mostly in excess of 600 paid to be reported using Forms 1099.

Clients may request that you complete and send an official W-9 when you run a business or work independently. The form asks for information such as the ICs name address social safety number SSN and more. Use the 2022 Tax Calculator to estimate 2022 Tax.

The person or the business that requested you to fill out a W9 will need the data on the form to file and furnish you with a copy of the appropriate information return. Use Form W-9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS to report for example. If the W-9 Form isnt filed the recipient will be subject to a 50 penalty per violation.

Use Form W-9 to provide correct taxpayer identification number to a requester or request one from an individual or a business. Contributions you made to an IRA. The purpose of Form W-9 is to provide the correct taxpayer identification number of the filer.

W9 Form 2022 Instructions to File. Form W-9 is used for providing taxpayer identification number of the recipient. This page is being updated for Tax Year 2022.

Form W-9 Printable 2018 2022 Fill out Form W-9 PDF. W9 Form 2022 A W9 form is a way for you to provide an individual or financial institution with your Taxpayer Identification Number TIN. W9 Form 2022.

Blank Fillable W 9 Form W-9 Request for Taxpayer Identification Number and Certificateis a frequently employed IRS form. The W-9 Request for Taxpayer ID Number and Certification form provides a company with the essential personal information about an independent contractor or freelancer in order to file tax returns in the United States. Participating foreign financial institution to report all United States 515 Withholding of Tax on Nonresident Aliens and Foreign Entities.

In any given situation someone is in need of the taxpayer identification number the W-9 Form is used to obtain it. It can also be used for requesting the taxpayer identification number of a business or an individual.

W9 Forms 2021 Printable Calendar Template Tax Forms Personal Calendar

W9 Form 2021 Printable Payroll Calendar

Pin On 1000 Examples Online Form Templates

Irs Tax Return Forms And Schedule For Tax Year 2022

Downloadable Form W 9 W 9 William Hill Us The Home Of Betting Rental Agreement Templates Doctors Note Template Tax Forms

2020 W9 Blank Form Calendar Template Printable Throughout Free Printable 2021 W 9 Form In 2021 Tax Forms Calendar Template Personal Calendar

W9 Tax Forms 2021 Printable Payroll Calendar

2020 W9 Blank Form Calendar Template Printable Throughout Free Printable 2021 W 9 Form In 2021 Tax Forms Calendar Template Personal Calendar

W9 Form 2021 Printable Payroll Calendar

W9 Tax Forms 2021 Printable Payroll Calendar

W9 Tax Forms 2021 Printable Payroll Calendar

W9 Form 2021 Printable Payroll Calendar

What Is Irs Form W 9 Turbotax Tax Tips Videos

W9 Tax Form 2013 W 9 Form Driverlayer Search Engine Tax Forms Irs Forms Resignation Letters

W9 Tax Forms 2021 Printable Payroll Calendar